Tether's fud

A seasoned Portfolio and Structured Product Manager with over 7 years of experience bridging traditional finance and Web3 venture capital. Currently managing 200+ portfolios, he specializes in connecting institutional banking expertise with emerging crypto markets.

Editor's Note: This article is authored by George Chu, and was originally published on his personal website. It is reprinted here with permission.

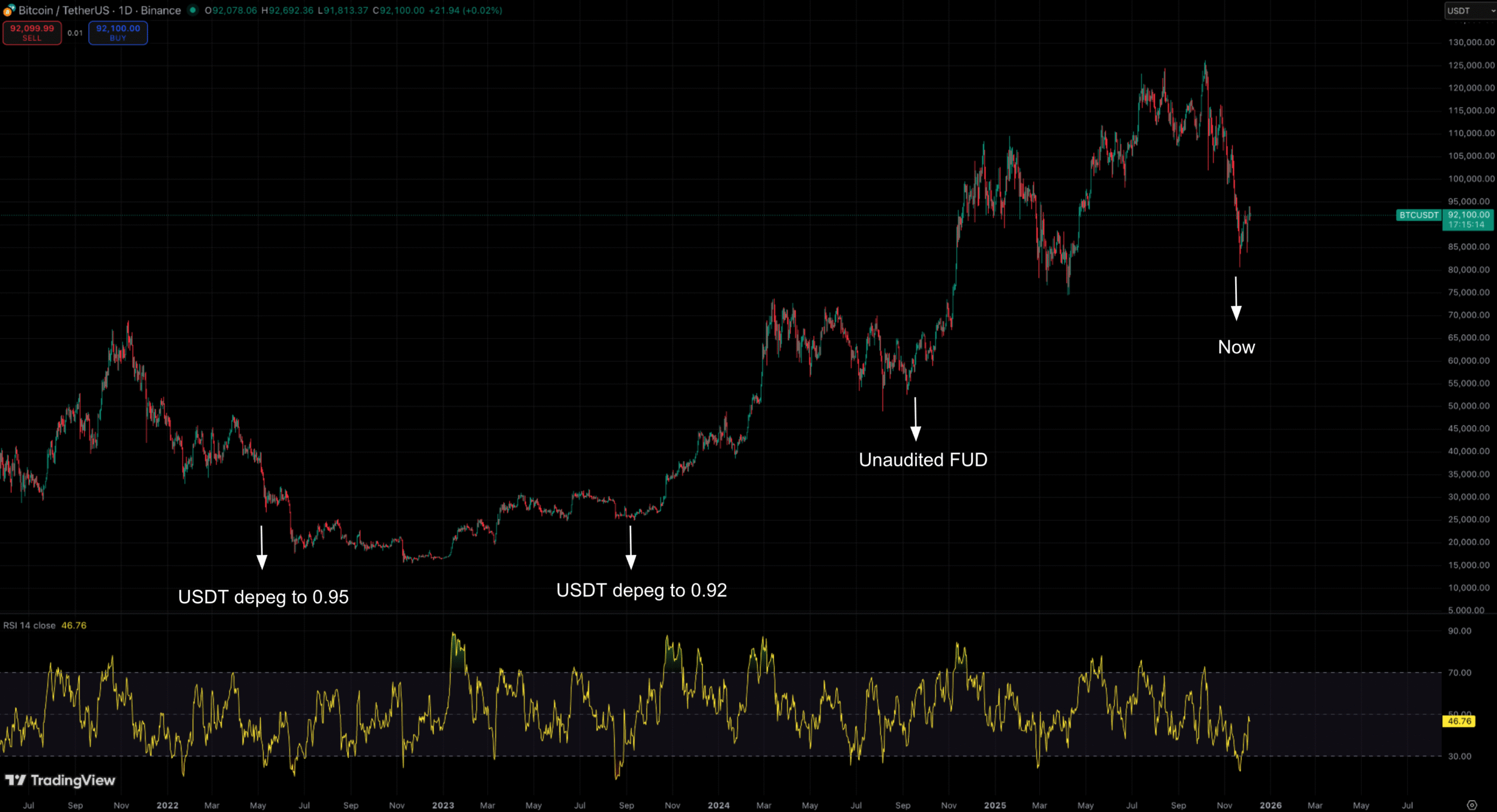

When market is desperate, doubt comes up.

Tether’s insolvency FUD doesn’t make sense.

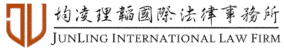

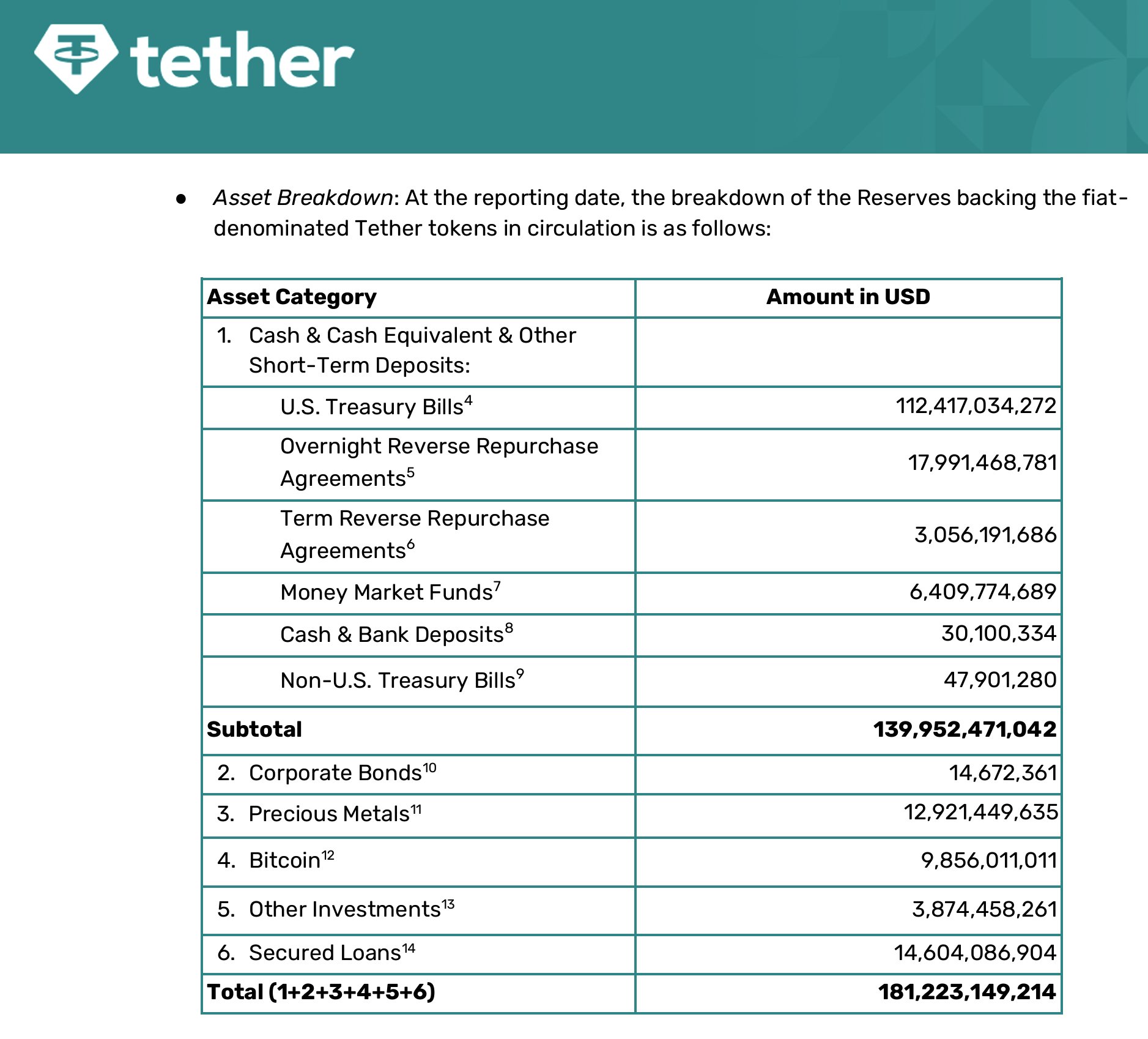

USDT, the largest stablecoin in digital assets, accounts for 68% of the $300 billion total market capitalization. The token serves as the backbone of the crypto industry, facilitating borderless capital flows and transactions with instant settlement. In contrast to modern stablecoins built on fancy delta-neutral strategies or algorithms, USDT is a fiat-collateralized token 1:1 backed by a reserve of US short-term Treasury and reverse repo to secure instant liquidity for redemption.

However, FUD went viral following the release of its latest audit report.

According to the statement, Tether’s balance holds approximately $21 billion (~10%) worth of Precious Metals (Gold in this case) and Bitcoin as a precaution to hedge against US monetary easing policy. Critics argue this allocation strategy constitutes “insolvency” of USDT as the asset is not 100% supported by fiat-backed baskets, which exposes USDT to potential value depeg if Gold and BTC experience severe drawdowns. The FUD subsequently triggered the downgrade of the stablecoin’s stability rating to the lowest level on S&P’s internal scale. The FUD subsequently triggered the downgrade of the stablecoin’s stability rating to the lowest level on S&P’s internal scale.

So Back to the Core Topic. Is USDT on the Verge of Default?

To answer the question, we must analyze whether the balance sheet captures the whole picture of Tether Group. There are three critical angles that are not fully reflected in the snapshot.

Underestimation of Profit and Excess Reserves

Tether holds ~$110 billion in interest-yielding treasuries which have generated ~4-5% annual profits since 2023. These asset reserves resulted in billions of undistributed profits, making it one of the most incredible revenue-generating machines in the crypto industry.

However, either social influencers or rating agencies, like S&P, didn’t account for these retained earnings in evaluation, which highly underestimates the firm’s capacity to absorb brutal redemptions.

Valuable Equity

Beyond the reserve assets, the enterprise itself holds considerable value. The USDT issuer is currently raising a $20 billion Series A round with 3% dilution, which implies a $600 billion valuation of the firm.

The round justifies the tremendous intrinsic value of brand dominance and the success of its money-printing mechanism. In the event of an unexpected crisis, the firm’s equity alone could easily cover any temporary drawdown on its Gold and Bitcoin holdings.

Precious Metal and Bitcoin

The inclusion of Precious Metals and Bitcoin should be treated as strategic diversification. Precious metals are widely adopted by central banks and financial institutions as highest-quality reserves. Those who challenge this asset are, in fact, arguing against the failure of establishing global finance and central banks.

Bitcoin, while possessing intrinsic price volatility, is undergoing an accelerated adoption by institutions and sovereign economies. We foresee more players utilizing this digital asset as a legitimate hedging solution against macro uncertainty and local currency depreciation.

Some Last Thoughts: A Comparison with Commercial Banks

Running a stablecoin business is somewhat similar to running a commercial bank, where the circulating stablecoins, or bank deposits, function as the liabilities on the balance sheet.

After the 2008 financial collapse, existing financial institutions operate under strict reserve requirements mandated by regulators. However, most banks typically keep only 10-15% of their assets on hand as cash and cash equivalents to handle daily operations. They allocate the majority of their assets in trading desks, long-term books, or lending to optimize revenue.

Tether, however, maintains over 90% of its reserves in highly-liquid US Treasuries and possesses billions in retained earnings to act as a buffer. From this perspective, the firm appears much more solvent than insolvent.

Fun facts, definitely not financial advice:

Tether FUD has marked market bottoms in history several times.